by: VectorVest Inc.

There’s no shortage of speculation about AAPL, but what happens when you strip away the opinions & predictions?

You get the truth. And the truth can lead to big profits (or protect your capital so you can live to trade another day).

VectorVest’s Stock Analyzer tool removes the emotion by letting math-based indicators take over the tedious task of interpreting what the numbers have to say.

So, let’s take a look at what’s really going on with AAPL, starting with VALUE.

While AAPL has traded as high as $134.54 (Split-adjusted, April 28, 2015), its current Value, based on a combination of interest, inflation and earnings data is slightly below that historic high at $123.09.

Compared to the recent September 12, 2016 close of $105.44, this means that AAPL’s stock is undervalued.

Does that mean you should buy right away?

Not necessarily.

Remember, $123.09 is what AAPL is worth at this moment. Clearly, the market is not willing to pay that price. Any number of factors can hold stocks back from reaching their true value, but the most important is how well (or poor) the company is expected to do in the future.

So, what’s needed next is an analysis of Apple’s long-term outlook. VectorVest’s RELATIVE VALUE (RV) indicator takes care of that by measuring the price appreciation potential over the next 1-3 years.

(Careful not to dismiss this indicator if you are a short-term trader – high RV stocks make excellent short-term trades too!)

Relative Value for Apple is 1.05 on the VectorVest indicator scale of 0.00 – 2.00 (anything above 1.00 is favorable), that means the prospects for AAPL trading higher over the next 1-3 years fall in the fair range. It also means that AAPL’s numbers point to a 5% better potential ROI than you could expect from investing the same amount in a AAA corporate bond.

Not the most tempting bargain, but before scratching it off your list, you should also consider whether the potential return is enough to warrant the risk.

That’s the job of Relative Safety (RS). The RS indicator is like a financial report card for a company. AAPL has an RS rating of 1.29. (Remember, above 1.00 is favorable on the VectorVest scale!)

Another win.

Safety is very good for AAPL.

The fundamentals confirm that AAPL is a solid company, but there’s still more that the VectorVest analysis has in store for you.

The ultimate trump card in our analysis is TIMING.

If you’ve ever bought a GREAT stock at the WRONG time, you’ve felt the pain it can cause first hand. In contrast, even the lousiest stock (umm… Enron, anyone?) can make an investor rich if they know when the time is right to buy and sell.

VectorVest believes that the time to buy a stock is when it’s already doing what you want it to do – that means rising in price -preferably in a rising industry and a rising market!

Talk about stacking the odds in your favor!

VectorVest’s Relative Timing indicator analyzes the price trend AND momentum for you. It analyzes all the dynamics of price, not just over 1-time frame, but four to let you know whether the stock is in an uptrend or downtrend and how fast it’s moving.

AAPL has an RT of 1.21 – Price is in an uptrend for the short-term and momentum is good.

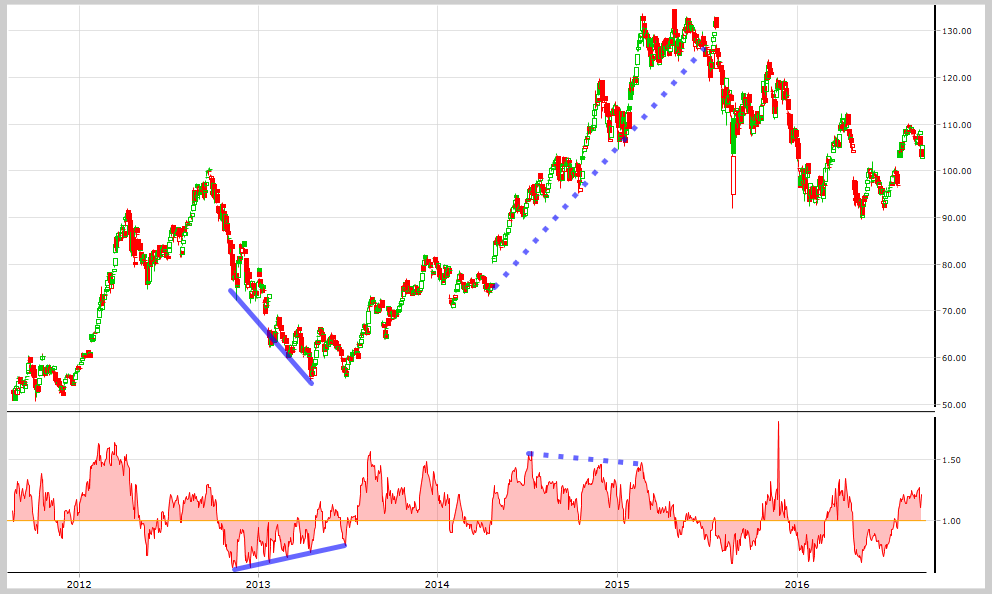

VectorVest’s RT Timing indicator often points out major reversals before they happen via bullish and bearish divergences. Looking at AAPL’s chart, you’ll see that even though price was falling rapidly in late April 2013, VectorVest’s RT indicators was on the rise. This was followed by a substantial price recovery. Conversely, as the stock hit a new 52-week high on April 28, 2015, Relative Timing was showing a bearish divergence with a series of much lower lows, preceding a nasty correction.

VectorVest sums up both the fundamental (value and safety) and technical (price trend) indicators on Apple using a single indicator – VST (that stands for Value, Safety & Timing). AAPL’s VST is 1.19 which is considered “good.”

(Pssst….This master indicator is genius when it comes to ranking dozens, or even thousands, of stocks from best to worst. For example, VectorVest’s top ranked stock in the Computer/Makers is Silicon Graphics/SGI with a Relative Value of 1.17, relative safety of 0.59, relative timing of 1.77 and a combined VST of 1.31. This stock’s combined VST outpaces Apple and overcomes its own poor sub-par Safety rating, due to incredibly strong short-term price momentum.)

At the end of the day though, you really just want to know whether to buy, sell or hold, right?

Well, according to VectorVest’s rule-driven rating system, Apple is currently a Buy due to its steady short-term price trend and favorable fundamental strength.

In closing, you should never buy a stock without knowing when to sell. VectorVest calculates a stop-loss price for every stock, every day, and the stop for AAPL is currently set at $97.08.

Is AAPL right for your portfolio? Only you can make that call, but now you have the un-biased information to help you make the most profitable decision.

Get all this information and more in VectorVest’s Instant Stock Analysis Reports – Visit www.vectorvest.be/analyze to analyze ANY stock FREE.

VectorVest has been providing the highest quality investment research to investors for 28 years. The company’s comprehensive approach to investing combines the insight of fundamental valuation with the power of technical analysis in an easy-to-use stock analysis software package designed for all types of investors. VectorVest provides a Buy, Sell or Hold rating for over 23,000 stocks each day based on its proprietary Value, Safety and Timing system. The demand for its indicators and market timing information has prompted worldwide expansion. Today VectorVest analyzes markets in the U.S., Canada, Europe, U.K., Singapore, Australia, Hong Kong and South Africa.